Are Carbon Credit Exchanges Good For Green Investments?

Are Carbon Credit Exchanges Good

Whether you want to offset your carbon footprint or just support sustainable projects, there are plenty of opportunities to invest in carbon credits. However, it’s important to understand the market before you jump in. There are several carbon credit exchanges that can help you make the right choice for your needs.

carbon credit exchange is a global initiative to reduce carbon emissions. The carbon markets allow polluters to offset their emissions by purchasing credits from entities that have negative emissions, such as reforestation projects. These credits are then sold to offset buyers, who can be companies or individuals. The credits are based on the amount of CO2 equivalent emissions avoided by the project and can be purchased in lots or units.

The main players in the carbon credit industry include the Carbon Trade Exchange (CTX) and Xpansive. CTX is one of the earliest players in the market and has been facilitating the exchange of carbon credits since 2009. The company offers a number of services beyond exchange facilitation, including carbon footprint calculation, carbon offsetting, and project development. Customers range from single brokerages and project developers to big corporations.

Are Carbon Credit Exchanges Good For Green Investments?

CTS is an online platform that allows traders to buy and sell standardized carbon credit contracts. The site uses the blockchain technology to enable trades with high speed, security, and scale. It’s designed to meet the needs of traders and investors who are looking to diversify their portfolio with green investments.

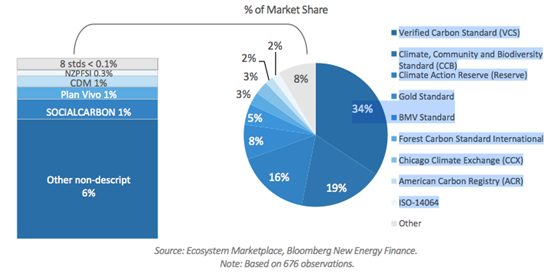

Despite their high popularity, carbon credit exchanges face a few challenges. For example, the voluntary carbon market lacks the liquidity needed for efficient trading. This is partly due to the heterogeneity of carbon credits. Every credit has different attributes, such as the type of project and its geography. The prices of these credits also differ, as buyers value additional attributes differently.

For instance, a reforestation project may be valued higher by buyers than a gas capture and storage (CCS) project. The problem is that it’s difficult to standardize these attributes across the market, making it difficult to match potential buyers with suppliers.

To overcome these challenges, the carbon market needs a new action plan to scale up. The matching of buyers and suppliers would be more effective if all carbon credits could be characterized using common features. For instance, a set of quality criteria, known as core carbon principles, should be agreed upon to verify that carbon credits represent genuine emissions reductions. Also, a standard taxonomy should be created to enable sellers to market their credits and buyers to easily find them. Currently, there are four different taxonomies in use, but they need to be unified. This will allow the carbon market to reach its full potential. In addition, the taxonomies should be more user-friendly and based on deeper data. This will facilitate the use of carbon credits by companies and individuals around the world. By doing so, the world will be able to move towards a lower carbon economy.